This month, explore the $1.44 Billion growth on the treasury bond market, Swiss wholesale CBDC trial, US Congress negotiations regarding public blockchains, the latest report by McKinsey & Company, and TOKENFUTURE2024 highlights.

Particula Digital Asset Classification System (PDACS)

As the landscape of digital assets rapidly evolves, precise navigation through its complexity and diversity becomes crucial for investors.

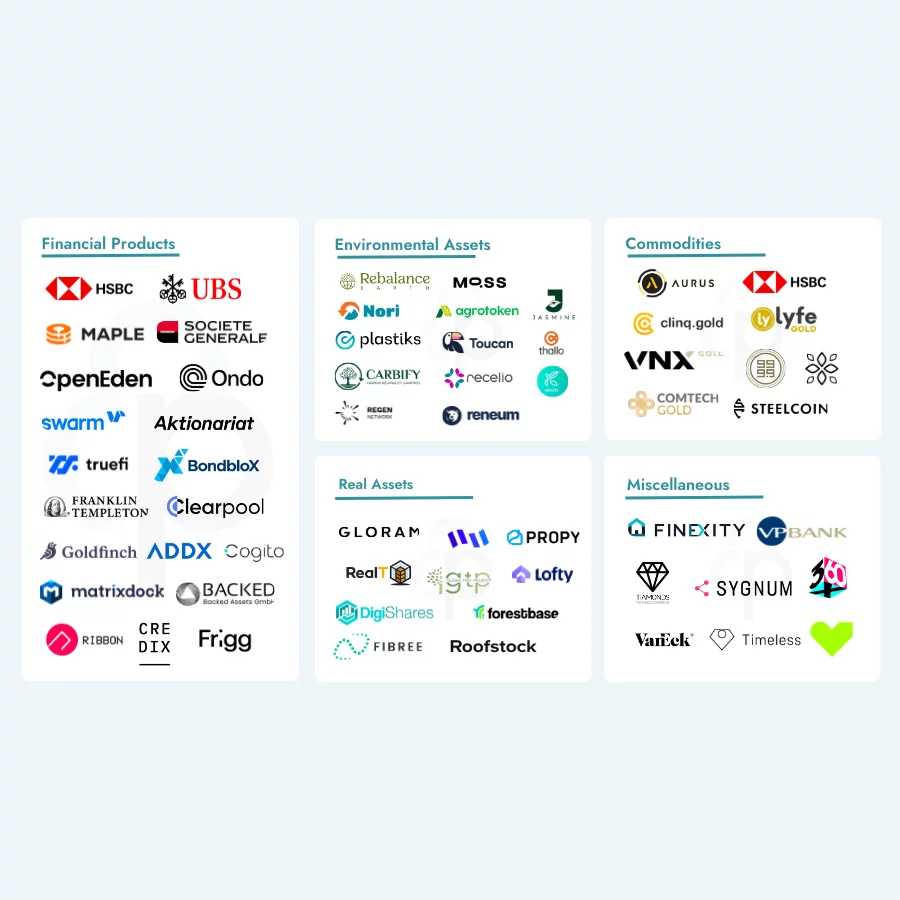

Tokenization of Real-World and Financial Assets: An Issuer Overview

As BlackRock partners with Securitize to launch a tokenized private equity fund, the landscape of asset management is experiencing a significant shift towards tokenization, which offers the potential to refine operations and enhance investment strategies.