The Prime

Rating Provider

For Digital Assets

Powering Issuers & Investors with Institutional-Grade Risk Ratings & Real-Time Risk Monitoring

Build Trust. Unlock Liquidity.

Particula provides independent risk ratings and real-time monitoring to reduce information asymmetry and empower asset allocators with the transparency needed to deploy liquidity.

Institutional-Grade Ratings, Reports & Monitoring Tools

Centered around independent risk ratings, our modular product suite includes

in-depth reports, real-time analytics, and comprehensive monitoring tools, designed to enhance transparency throughout the digital asset lifecycle.

Ratings

Independent risk scores that turn complex token structures into clear, comparable measures of risk and quality - covering counterparties, issuance structures, and underlying assets.

View ratings page

Reports

Detailed analyses that build on risk scores with qualitative insights - showing strengths and challenges, benchmarking against peers, and highlighting key product features.

View report page

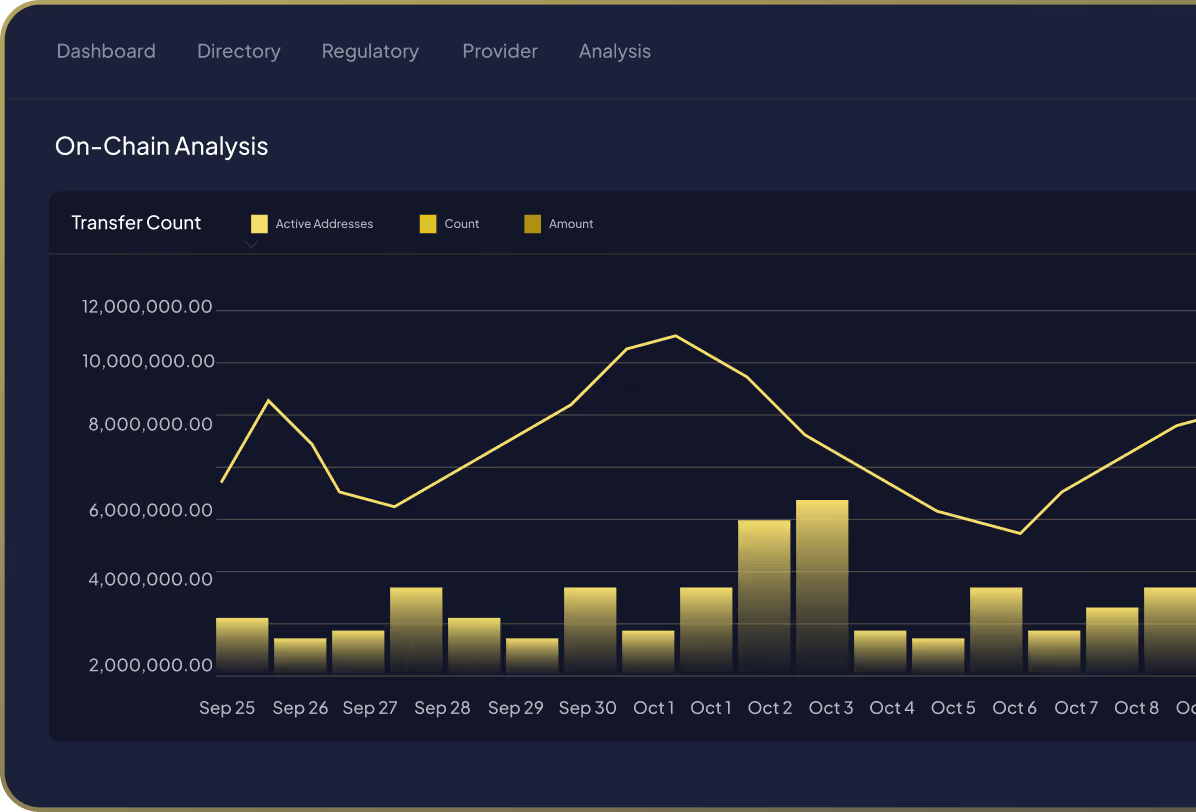

Monitoring

Ongoing tracking of on- and off-chain metrics, operational and technical updates, and regulatory changes - with live risk indicators and real-time data to maintain transparency.

View monitoring page

Latest News & Insights

.png)

Particula Launches the Digital Asset Risk Passport (PDARP) - Programmable Risk Infrastructure for Onchain Capital Markets

After three years and 200+ risk assessments across tokenized assets, Particula brings institutional-grade risk intelligence onchain, enabling protocols, allocators, and issuers to verify risk, react automatically, and scale tokenized finance with confidence.

The Future of Digital Finance

Subscribe for the latest updates on tokenization and digital asset risks.

.svg)