This month, explore the $1.44 Billion growth on the treasury bond market, Swiss wholesale CBDC trial, US Congress negotiations regarding public blockchains, the latest report by McKinsey & Company, and TOKENFUTURE2024 highlights.

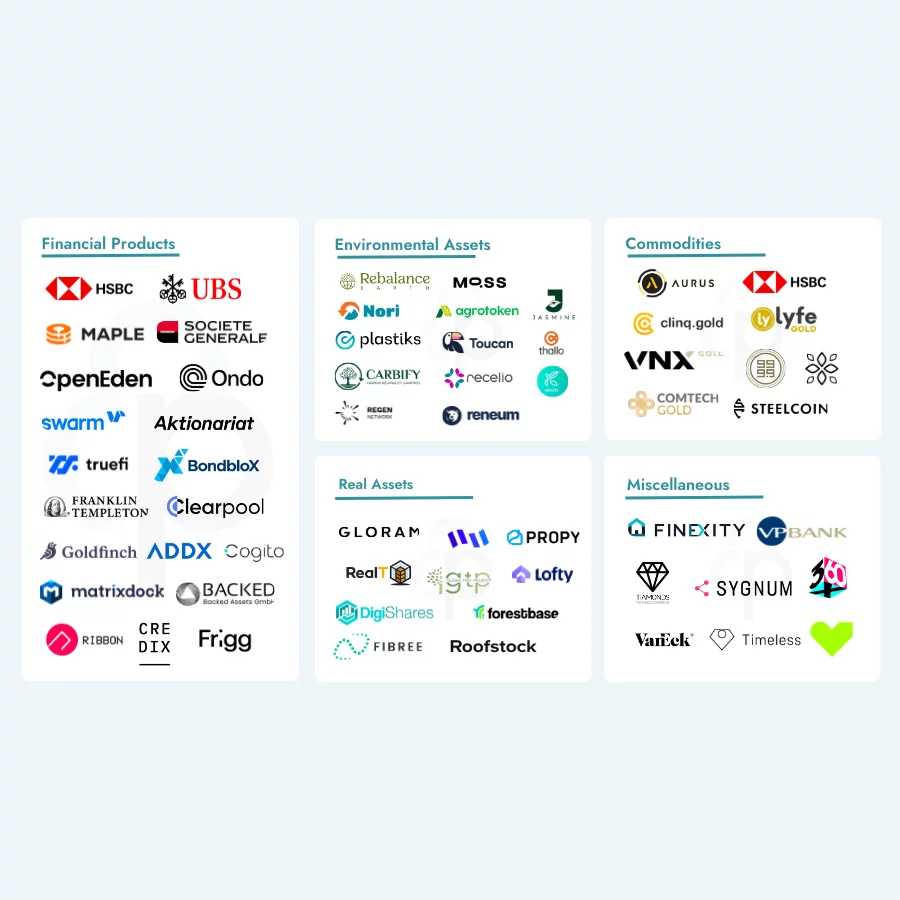

Tokenization of Real-World and Financial Assets: An Issuer Overview

As BlackRock partners with Securitize to launch a tokenized private equity fund, the landscape of asset management is experiencing a significant shift towards tokenization, which offers the potential to refine operations and enhance investment strategies.