Issuer Spotlight: Backed

Backed is a tokenized asset issuer bridging financial assets on-chain that has recently secured $9.5 million in a Series A funding round to enhance its private tokenization services, connecting asset managers and funds with blockchain technology.

Background

Backed was founded in Zug, Switzerland, in 2021 and moved its issuance operations to Jersey in early 2024. Backed's central operations revolve around the issuance and redemption of “bTokens”, permissionless ERC-20 tokens on EVM-compatible chains that track the price of an underlying asset, which is held on their behalf by licensed third-party custodians.

Currently, Backed has 17 tokens on the market. The tokens convey legal ownership of structured products which are fully backed by the underlying asset, including accumulating fixed-income products such as US Treasury Bond and Corporate Bond ETFs and equities. At the time of writing, token issuance volume has surpassed $50 million.

Tokenization Services for Financial Institutions

Backed has launched a new suite of services tailored for financial institutions, emphasizing security and compliance. The new services include Tokenized Trackers, Tokenized Actively Managed Certificates (AMCs), and a Tokenization Platform. In addition, Backed integrated Chainlink’s Proof of Reserve technology for selected tokens, which are on-chain attestations of assets in custody, audited by The Network Firm.

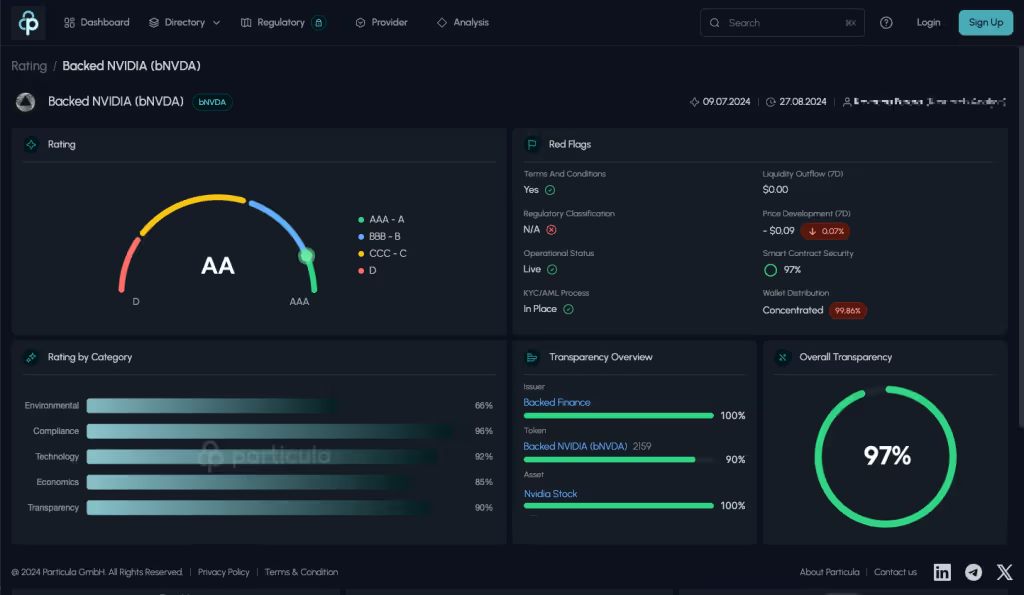

Example Token - Rating Abstract - Backed NVIDIA (bNVDA)

In July 2024, Particula assigned an AA rating* to the issuance of Backed NVIDIA token by Backed. The bNVDA token is a tracker certificate issued as an ERC-20 token tracking the price of NVIDIA Corporation stock. The rating reflects the token’s strong market presence, robust product structure, and secure, transparent infrastructure, supported by regulatory oversight.

Key strengths include the token’s compliance with MiFID regulations and its integration within a broad blockchain ecosystem. However, challenges such as counterparty risk, technical vulnerabilities, and market liquidity constraints were noted. bTokens are designed for both professional and retail investors, with their successful issuance and operation relying on the effectiveness of Backed's risk management practices and the evolving regulatory landscape.

Rating: AA rating* assigned by Particula in July 2024 for the bNVDA token.

Regulatory Compliance: The token is MiFID compliant and under strict regulatory oversight.

Market Presence: Backed ranks among the top 10 issuers of tokenized public securities with a 2.4% market share.

Blockchain Ecosystem: Integrated across multiple blockchains including Ethereum, Arbitrum, and Polygon.

Key Strengths: Strong market presence, high compliance standards, and low custodial risks.

Challenges: Counterparty risks, technical vulnerabilities, and liquidity constraints.

Target Investors: The token is primarily available to professional investors. A partnership with INX, which lists them as an approved participant in their prospectus, has enabled retail secondary market trading (excluding the US and Canada). Backed has recently announced a similar partnership with eNor Securities.

Future Sensitivities: Potential rating changes may arise from shifts in regulatory requirements or market sentiment.

Download Report

*Disclaimer

The information and analyses related to crypto values, crypto tokens, and other digital assets (“Digital Assets“) provided by Particula GmbH (“Particula“) are exclusively made available to entrepreneurs within the meaning of § 14 BGB and are intended solely for informational purposes. The provided information and analyses do not constitute a rating as defined in Art. 3 para. 1 lit. a) of Regulation EG/1060/2009 (“Rating Regulation“). A creditworthiness assessment as defined in Art. 3 para. 1 lit. a) of the Rating Regulation, evaluating the issuer’s creditworthiness, is expressly not part of the analysis.

Copyright ©2025 Particula. All rights reserved.

Latest News & Insights

Particula Selected To Co-Structure RFP and Provide Independent Ratings for Keel's $500M Regatta Program

Abu Dhabi, UAE – December 11, 2025 – Particula, the leading rating provider for digital assets, today announced its collaboration with Kinetika Research on the 500M Keel Solana Tokenization Regatta.

.svg)