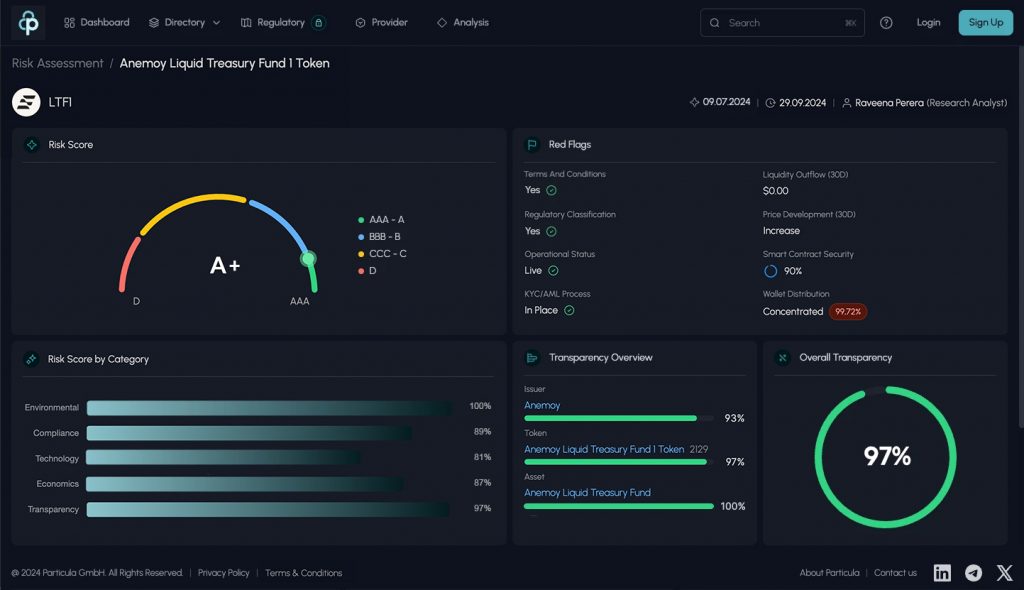

Report Highlights

Particula assigns an A+ rating* to the issuance of the Liquid Treasury Fund 1 ($LTF) token by Anemoy as of September 9, 2024, with a positive outlook. The $LTF token primarily reflects participation in U.S. Treasury Bills.

The rating favorably reflects the issuer's bankruptcy-remote operational structure, which operates under stringent regulatory oversight and the robust product design supported by an efficient technical infrastructure. It also takes into account the direct ownership of fund shares, strong reporting and transparency practices and the high quality of the underlying assets. However, the rating highlights certain challenges, including legal risks, key person and concentration risks, operational and market presence risks, as well as counterparty risks associated with the issuance of $LTF.

Key Strengths:

Bankruptcy-Remote Operational Structure with Regulatory Oversight, Robust Product Structure Backed by Efficient Technical Infrastructure, Direct Ownership of the Underlying Asset Provided as Fund Shares, Strong Reporting & Transparency Practices, Low-Risk & High-Quality Underlying Asset Structure.

Challenges:

Key Person & Concentration Risks, Operational & Market Presence Risks Related to Anemoy, Third-Party Integration & Dependency Risks, Investor Exposure to Legal Risk.

*Disclaimer

The information and analyses related to crypto values, crypto tokens, and other digital assets (“Digital Assets“) provided by Particula GmbH (“Particula“) are exclusively made available to entrepreneurs within the meaning of § 14 BGB and are intended solely for informational purposes. The provided information and analyses do not constitute a rating as defined in Art. 3 para. 1 lit. a) of Regulation EG/1060/2009 (“Rating Regulation“). A creditworthiness assessment as defined in Art. 3 para. 1 lit. a) of the Rating Regulation, evaluating the issuer’s creditworthiness, is expressly not part of the analysis.

Copyright ©2025 Particula. All rights reserved.

Risk Rating

A+ rating* assigned by Particula in September 2024 for the Liquid Treasury Fund 1 ($LTF) token

Regulatory Compliance

Licensed to Operate as a Professional Fund by the British Virgin Islands Financial Services Commission (BVIFSC)

Market Cap(As of Sep 9, 2024)

$37,896,738.62

Blockchain Ecosystem

Integrated across multiple blockchains including Ethereum, Celo, Centrifuge Chain, Abitrum & Base

Target Investors

The fund is only open to professional investors