Key Benefits

Particula’s Market and Rating Intelligence

Informed Decision-Making

With our comprehensive Market and Rating Intelligence, customers gain access to valuable insights and analysis of tokenized real-world assets. This empowers them to make well-informed investment decisions, identify potential risks, and capitalize on emerging opportunities in the tokenized asset market.

Competitive Advantage

Our Market Intelligence service provides customers with a deep understanding of market trends, competitors, customer preferences, and overall industry dynamics. Armed with this knowledge, customers can stay ahead of the competition, identify gaps in the market, and develop strategies that give them a competitive edge.

Risk Mitigation

Particula’s Rating Intelligence service offers a thorough assessment of tokenized assets from multiple dimensions, including transparency, technology, compliance, economics, and environmental factors. By understanding the quality and potential risks of tokenized assets, customers can mitigate risks, protect their investments, and ensure compliance with legal and regulatory requirements.

Key Benefits

Particula’s Market and Rating Intelligence

Informed Decision-Making

With our comprehensive Market and Rating Intelligence, customers gain access to valuable insights and analysis of tokenized real-world assets. This empowers them to make well-informed investment decisions, identify potential risks, and capitalize on emerging opportunities in the tokenized asset market.

Competitive Advantage

Our Market Intelligence service provides customers with a deep understanding of market trends, competitors, customer preferences, and overall industry dynamics. Armed with this knowledge, customers can stay ahead of the competition, identify gaps in the market, and develop strategies that give them a competitive edge.

Risk Mitigation

Particula’s Rating Intelligence service offers a thorough assessment of tokenized assets from multiple dimensions, including transparency, technology, compliance, economics, and environmental factors. By understanding the quality and potential risks of tokenized assets, customers can mitigate risks, protect their investments, and ensure compliance with legal and regulatory requirements.

All-In-One Data Platform

Particula Provides a Comprehensive Platform Offering Resilient, Customized Tools to Excel in the Tokenized Asset Market.

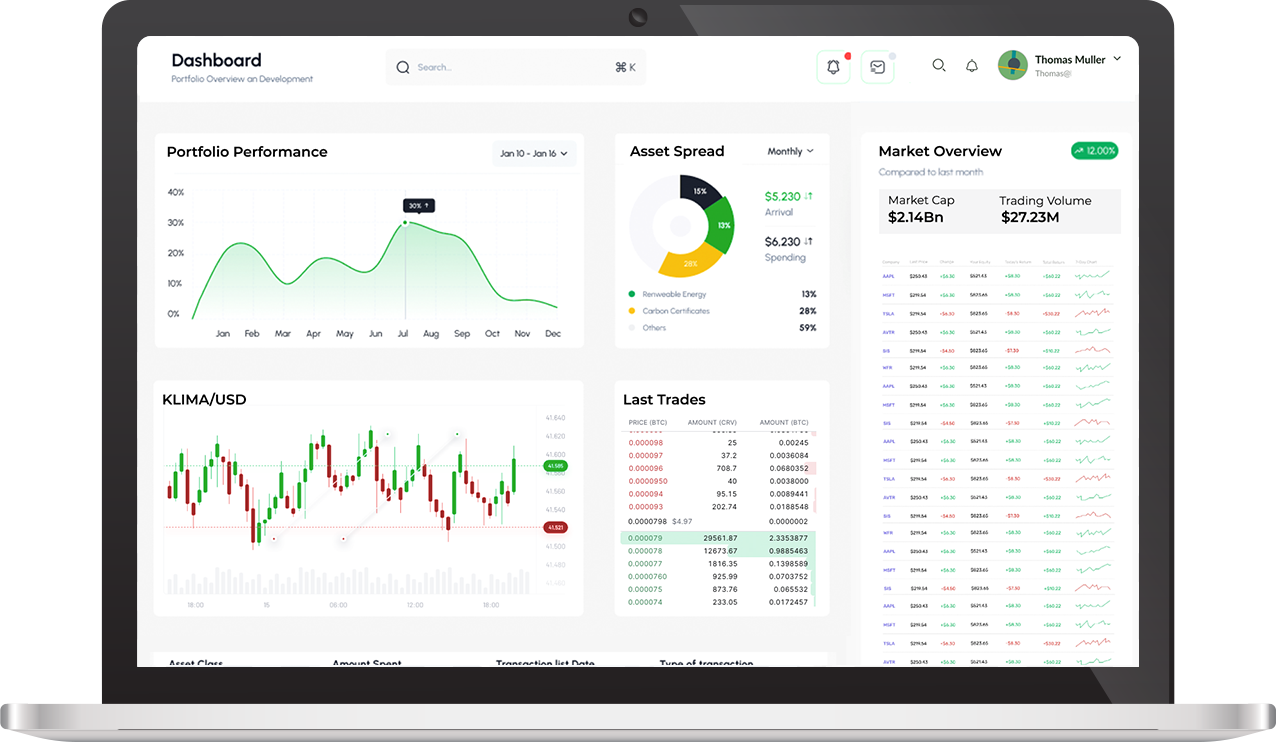

Market Intelligence

Particula’s Market Intelligence service provides you with invaluable insights into the ever-evolving world of tokenized real-world assets. We gather and analyze information about market trends, competitors, customer preferences, and overall industry dynamics. With our comprehensive market intelligence, you can stay ahead of the curve, make informed decisions, and capitalize on emerging opportunities in the tokenized asset market

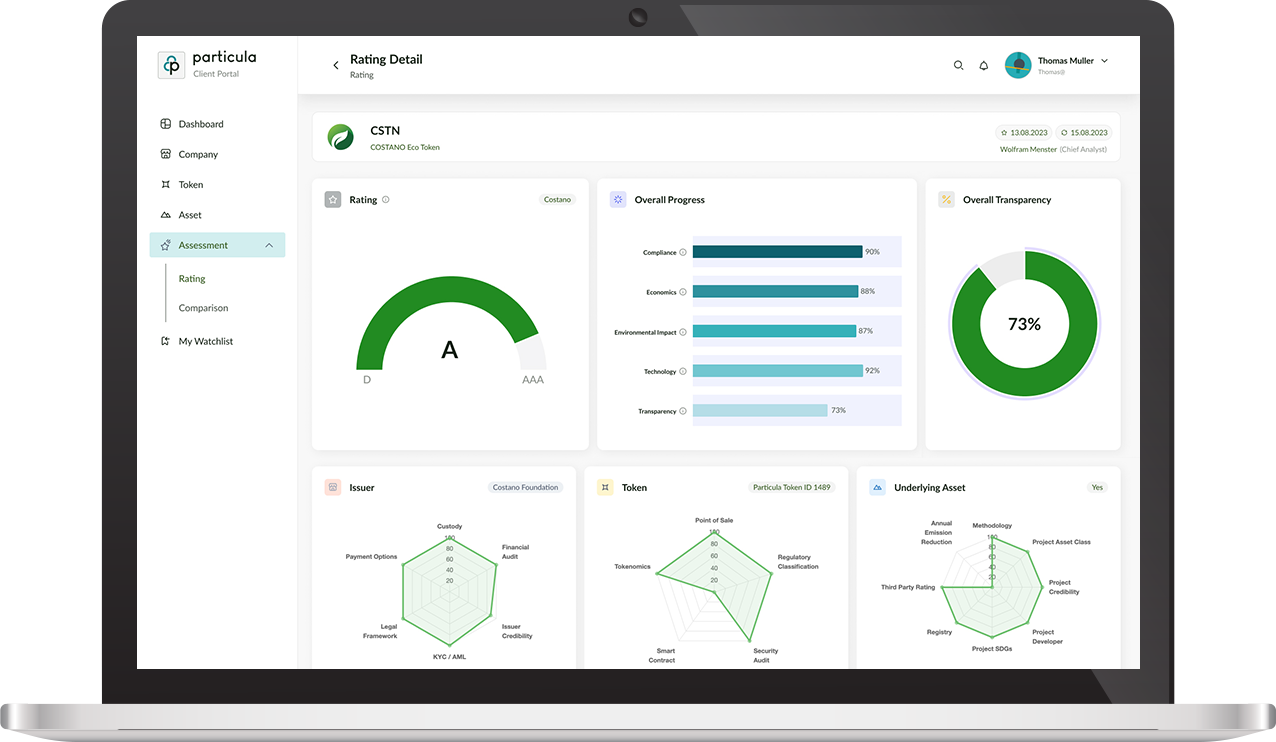

Rating Intelligence

Particula’s Rating Intelligence service offers a deep dive into the analysis and understanding of tokenized real-world assets within the context of blockchain and finance. We scrutinize assets from multiple dimensions, including transparency, technology, compliance, economics, and environmental factors. Our proprietary rating system converts these dimensions into an overall rating, ranging from AAA (highest) to D (lowest), providing you with a clear and comprehensive assessment of the quality and potential risks of tokenized assets. Whether you’re concerned about legal aspects, security, tokenomics, or other factors, our Rating Intelligence has you covered.

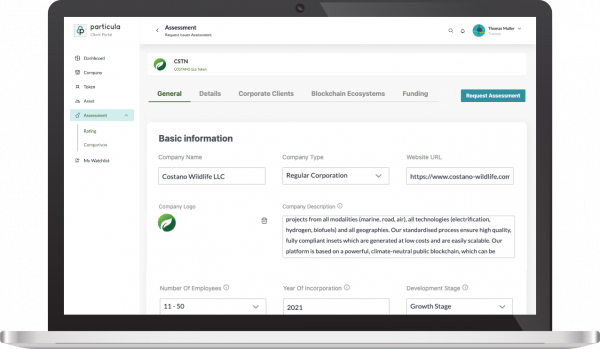

Due Diligence on Demand

Particula’s Due Diligence on Demand service offers a thorough and customized analysis of tokenized real-world assets tailored to your specific needs. Whether you’re an investor, issuer, or regulator, our team of experts will conduct a comprehensive assessment of the asset in question, covering aspects such as legal compliance, security, tokenomics, and more. With our Due Diligence on Demand, you can gain a deeper understanding of the asset, mitigate risks, and make well-informed decisions.

Best-in-Class Datasets

Particula Delivers Comprehensive Coverage of the Digital Asset Market

“

With their database, Particula has created an added value that I have never seen elsewhere in the market. Their analysis provide unprecedented insights

and transparency in the area of digitized assets that surpass what

can be achieved even with numerous hours of research.

Absolutely phenomenal!

Simon Tribelhorn – Managing Director of the Liechtenstein Bankers Association

FAQs: Simplifying the World of Tokenized Real-World Assets

Explore our frequently asked questions to learn more about tokenized real-world assets, how our rating system works, and the features and services we offer on our platform.