A

Abstract

Financial institutions, asset managers and investors are now more likely to use three or more external data providers to analyse the ESG characteristics of investments. They want to compensate for the problem of inconsistency and insufficient quality of data by increasingly using external data providers. While the cost and effort of ESG research is increasing for them, the future looks bright for database providers. ESG data fintechs in particular are more interesting to venture capitalists than ever before.

A

Introduction

The transformation towards a more responsible society, better governance practices as well as resource-efficient economies is prompting companies and financial institutions to become fully aware of their investment and issuance positions and to integrate ESG considerations into their reporting and risk management.

One result of this change is the continuous increase in the number of ESG data providers in recent years. However, so far there is no participant in the market that is able to offer a holistic solution for all ESG criteria. As a consequence, financial institutions, asset managers and investors have to rely on a combination of different ESG data providers and consultancies as a solution.

In 2021 67% of investors in Germany used multiple data sources when dealing with ESG-related challenges (vs. 75% both globally and in Europe). To analyse the sustainability of their own investments, 57% involved one or two third-party data providers (vs. 54% globally and 50% in Europe).

Mainly due to the low level of trust in the data provided by the companies themselves, a fintech ecosystem has emerged that aims to provide information beyond this. For this purpose, efforts are being made to integrate new technologies such as big data, natural language processing, blockchain, the internet of things, satellite imagery and robo-advisors to provide alternative sources of data.

With proper integration of these new technologies and alternative data sources, an investor can potentially gain a significant competitive advantage.

The main Challenges for Investors

Unfortunately, this is not straightforward. Compared to financial reporting, the reporting of ESG dimensions is not standardised. Until the Corporate Sustainability Reporting Directive (CSRD) comes into force in 2024, companies are not required to report most ESG-related information. As a result, current practice is fragmented and inconsistent. The CSRD aims to ensure that sustainability reporting is treated integrally and will put on an equal level to financial matters.

Therefore it was highlighted in the BNP Paribas ESG Global Survey 2021 that the inconsistent data quality remains the biggest barrier to ESG integration for investors.

A

In particular this means:

- a lack of consistency of data across asset classes,

- no forward-looking data for scenario analysis,

- a low correlation between ESG data providers due to inconsistent methodologies and data sources,

- insufficient detail in data to measure impacts at the local level,

- no concrete reference to the UN Sustainable Development Goals (SDGs),

- a low frequency of data updates or

- a low confidence in the quality of information provided by companies due to, among other things, inconsistent methodology and disclosures.

Solutions to the Data Challenge

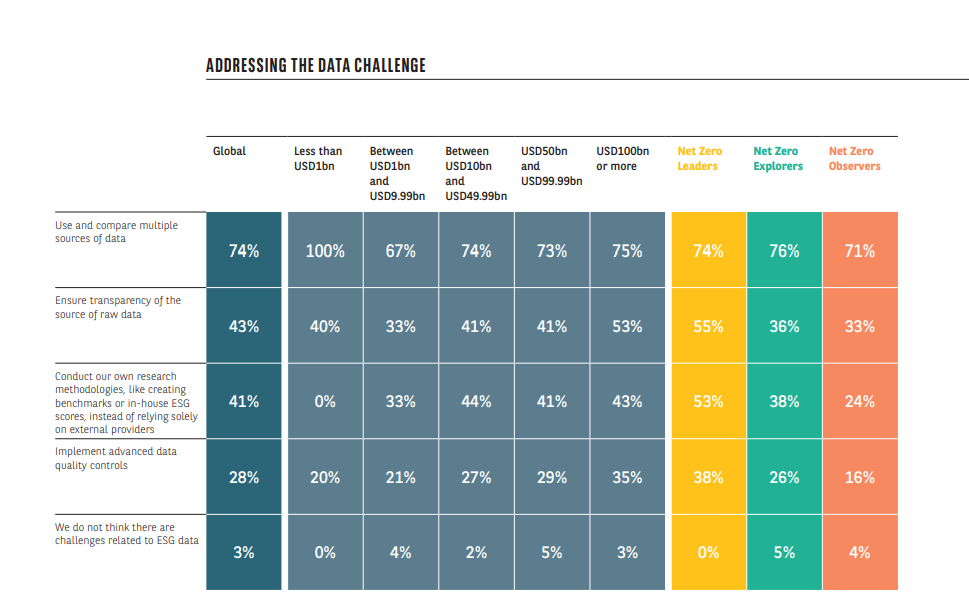

So far, there is no magic formula for solving the problems mentioned above. However, in the past year it could be observed that especially large institutes intensified their efforts to develop their own indicators and research methods. In addition, the internal quality controls of incoming raw data as well as the verification of transparent collection increased.

But this cannot be seen as a potential solution to the problem. Individual solutions only lead to a lack of convergence and reduced standardisation. In order to prevent further fragmentation of the market, it is therefore necessary to increasingly rely on standardised, external data providers.

This trend is already noticeable. Larger investors and net zero leaders are now more likely to use three or more external data providers to analyse the ESG characteristics of investments. As the amount of data is expected to continue to increase over time, the number of external data providers used will also further increase.

A

Impact for Database Provider

While the cost and effort of ESG research is rising for financial institutions, asset managers and investors, the future is looking bright for database providers.

In this context, ESG data fintechs in particular have unique potential to grow rapidly, drive paradigm-shifting innovation and help finance social and environmental improvements. They are predestined to attract capital investment in the years to come to support their environmental and social improvement efforts, while generating significant returns.

As Larry Fink — CEO of Blackrock — wrote in his annual letter: “The next 1000 billion-dollar start-ups will be those “that help the world decarbonize [..]”.