Scenario 2— Centralized Traditional Registry bridges to Decentralized Blockchain Registry

A

Abstract

Carbon markets are rapidly developing, and where compliance schemes are missing, the voluntary carbon market steps in. However, the voluntary carbon market is not without criticism and many are advocating for higher quality carbon offsets, greater stringency, and larger supply chain transparency. Blockchain technology is often seen as a way to overcome those criticisms, but there is no firm consensus on how blockchain technology should be used in practice for carbon markets. In a six part series we want to outline the different approaches of bringing carbon removal certificates on-chain. In this article we shed some light on the reasons the two big traditional registries, Verra and Gold Standard, put tokenizing their credits on hold.

A

Introduction

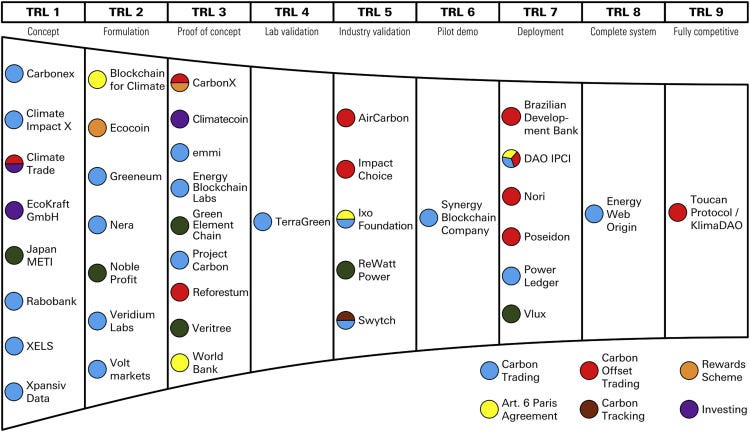

While there is a lot of talk about tokenizing carbon credits, there aren’t many companies that are yet able to implement this at scale. In fact a recent study completed by One Earth in October 2022 found that only one company was able to do so fully competitively. The magazin assessed the current blockchain ecosystem by classifying 39 organizations working in the sector with a technology readiness level (TRL) scale. The results of the study showed that more than 50% of projects are still at the proof-of-concept (TRL <= 3) level and that only the Toucan Protocol has reached maturity (TRL 9).

A

What is the Toucan Carbon Bridge?

The Toucan Carbon Bridge connects the traditional voluntary carbon market to the world of web3 and pretty much allows anyone to bring their carbon credits from legacy registries onto the Toucan Registry. For each registered credit from Verra that is bridged, one tokenized CO2 token (called “TCO2”) is minted and deposited on the blockchain.

TCO2 tokens still carry all the attributes and metadata making them specific to a given project and vintage. This is crucial because voluntary market carbon credits trade at very different price points due to credits of a certain type or with specific attributes being more sought-after than others.

Carbon Pools, Base Carbon Tonne & Nature Carbon Tonne

However, the downside to this is that they are specific to a single project and vintage, which makes these tokens not very liquid. This is why Toucan created so-called carbon pools, which bundle multiple project-specific tokenized carbon tonnes (TCO2 tokens) into more liquid carbon index tokens, enabling price discovery for different classes of carbon assets (i.e. by project type, country, carbon standard or co-benefits).

In October 2021 Toucan released its first pooled carbon asset called Base Carbon Tonne (BCT). Within eight weeks over 15 million carbon credits have been tokenized and nearly all of the carbon tokens have been deposited into the Base Carbon Pool. BTC consists of all carbon credit types (solar, wind, nature-based, etc.) from Verra Carbon Units (VCU) of 2008 vintages or later, while the Nature Carbon Pool that backs the “NCT” token only accepts carbon tokens that are created with nature-based methodologies from vintages of 2012 onwards.

With all the potential benefits for the Voluntary Carbon Market, why did Verra stop the tokenization from Toucan?

On May 25th, 2022 Verra prohibited the practice of creating tokens based on retiring credits and launched a public consultation on this subject that was held for 60 days from early August 2022 to early October 2022. The two main reasons for stopping the tokenization of existing credits were:

- The immediate retirement of the credit in the VCU and the nature of the one-way blockchain bridge and

- the conversion of certificates as old as 2008 and the speculative element of the transition rather than the focus on carbon removal.

Immediate Retirement of Verra Credits

The graphic above visualizes the underlying tokenization process. To make the different scenarios of our six part series comparable, the underlying project scenario on the left hand side remains unchanged.

As shown on the right hand side, the Verra VCUs were retired immediately when brought on-chain through the Toucan Carbon Bridge. Understandably, Verra considers it important that a retirement of a credit is intended to represent the consumption of the VCU’s environmental benefit and, in doing so, permanently withdrawing that VCU from the market rather than transferring it to another blockchain-based registry.

Conversion of Verra Credits from 2008

While it wasn’t explicitly expressed as the main problem, reading between the lines clearly reveals Verra’s disliking of the speculative element of pooling carbon credits as old as 2008. While those were technically not yet retired, it hints that by pooling them, they blend in with the other tokens/credits and no longer provide any insights into the quality of the project — or lack therefore.

Conclusion

While Toucan has mastered the technology and managed to scale the transfer of credits from legacy registries like Verra onto the blockchain, those legacy registries will no longer allow one-way token bridges that immediately retire a carbon credit. One option for the future will be 2-way token bridges (as featured in our initial Medium article about the different way to tokenize carbon credits), but even a well functioning 2-way token bridge begs the question if a centralized official registry with a synced decentralized blockchain-based registry truly makes sense.

Stay tuned to learn about other existing ways blockchain technology has been utilized to bring carbon credits on-chain.