As the landscape of digital assets rapidly evolves, precise navigation through its complexity and diversity becomes crucial for investors.

Merging advanced technology with traditional asset principles, these new investment vehicles offer unique challenges and opportunities that differ across sectors and asset types, demanding a novel and specialized approach to their evaluation.

But the development of a standardized valuation framework for digital assets encounters significant challenges, primarily due to the lack of uniform standards and industry consensus. This challenge is compounded by investors’ lack of a unified understanding and standardized terminology to precisely differentiate digital assets. The diversity in formats and the varying scope of information provided by issuers further complicate the establishment of a consistent comparison methodology, thorough due diligence, and a systematic approach to quality assessment and benchmarking. These hurdles obstruct reliable price discovery, underlining the need for an innovative and comprehensive classification system to effectively manage the inherent risks and unlock the potential returns for investors.

Our Offering

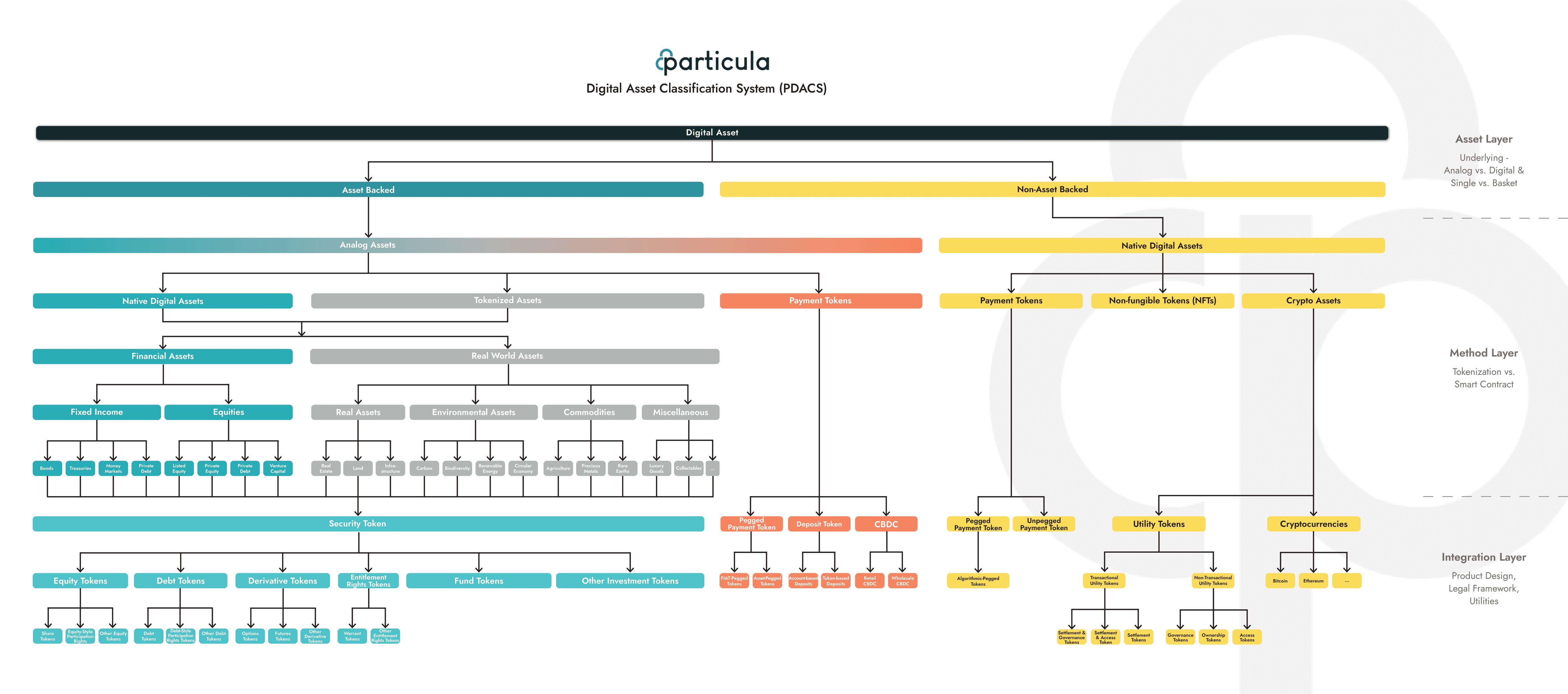

The Particula Digital Asset Classification System (PDACS) offers a comprehensive taxonomy for classifying digital assets across three dimensions, focusing on their unique product characteristics.

Core Premise

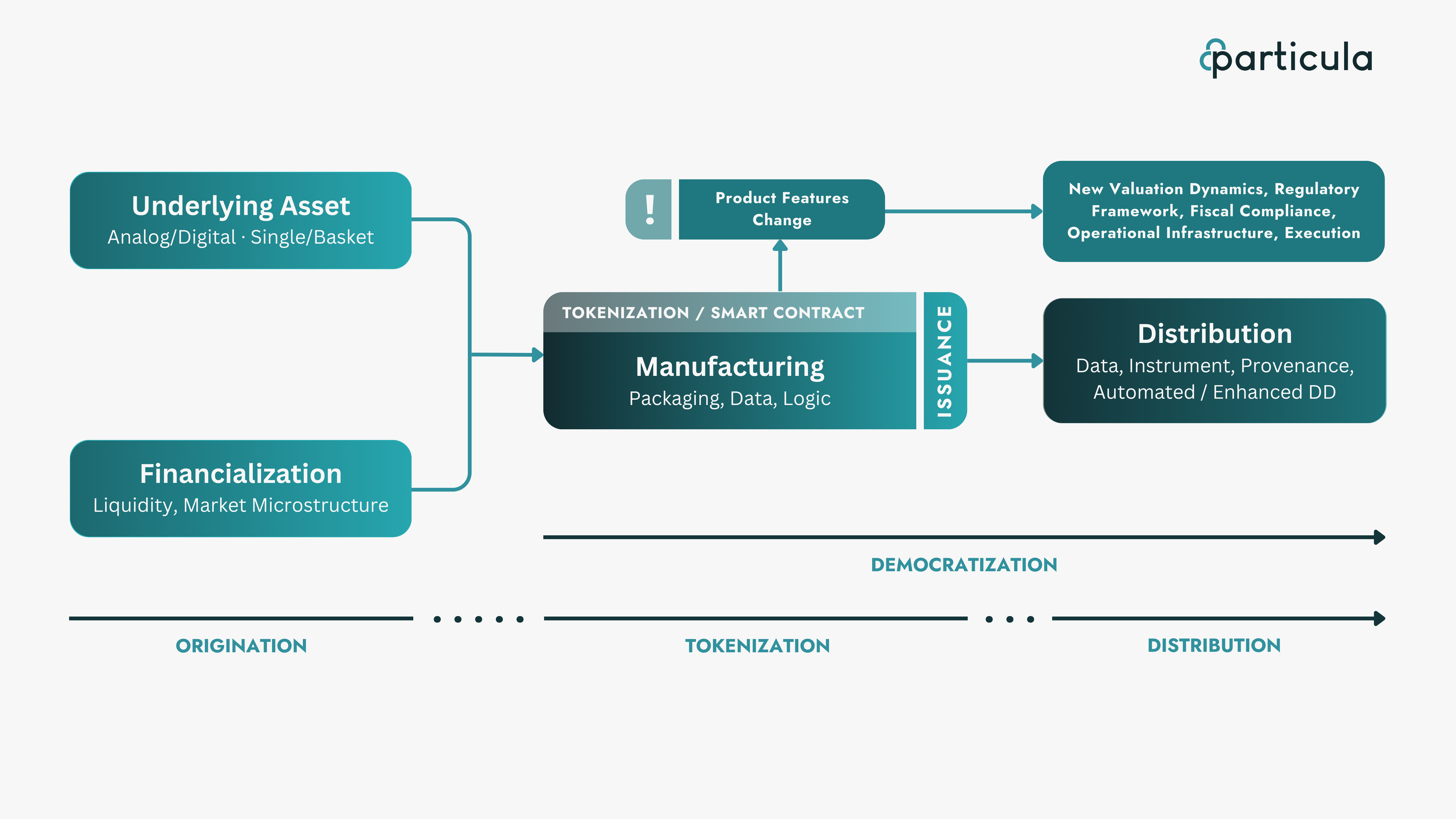

The tokenization process or the addition of smart contract logic fundamentally changes all key product features of any underlying asset. This change affects operational infrastructure, valuation mechanisms, fiscal compliance, and the applicable legal framework that requires a new perspective on asset classification.

Tokenization Creates a Separate Asset Class with Unique Product Features

Source: Particula, Peter Golder, 2024

Classification Overview

1. Asset Layer

At the first level, the token is valued in terms of its underlying asset, distinguishing between analog and digital underlyings and considering structuring as a single asset or as a collective basket. The aim is to determine whether the value of the token is backed by a tangible asset.

2. Method Layer

Here, the token is evaluated based on its manufacturing process, identifying whether it involves tokenizing an existing analog asset – effectively adding a technological layer to a pre-existing product – or constructing a new smart contract to embed data and logic for digital-only underlyings or assets issued directly on-chain.

3. Integration Layer

The concluding classification incorporates the product’s structural nuances, taking into account both smart contract functionalities and the issuer’s terms and conditions. This assessment focuses on ownership rights, utilities, cash flows, and the resulting legal classifications, aiming to provide a conclusive understanding of the token’s regulatory and operational framework.

Conclusion & Outlook

PDACS introduces a standardized framework for digital asset classification, considering the underlying asset, manufacturing process, and specific product structuring, along with investor rights and regulatory implications. It equips stakeholders with a unified communication platform, enabling accurate risk anticipation and opportunity identification. Additionally, PDACS lays the groundwork for further market standardization and underpins our programmatic rating framework, facilitating a consistent, automated, and thus comparable assessment of digital assets. This approach not only enhances market transparency but also fosters informed decision-making in the dynamic digital asset ecosystem.

Learn More About Particula

At Particula, we have developed the first rating and analytics platform for digital assets. Our goal is to provide the next generation of ratings for the next generation of assets in order to give investors instant security, clarity and better market access.

To learn more or gain access to our platform, please contact our co-founder and CGO, Nadine Wilke, at nadine.wilke@particula.io

Copyright ©2024 Particula. All rights reserved.

The information, methodologies, data and opinions contained or reflected herein are proprietary of Particula and/or its third parties suppliers (Third Party Data), are provided for informational purposes only and may be made available to third parties provided that appropriate citation and acknowledgement is ensured. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose.

Their use is subject to conditions available at https://particula.io/disclaimer/.