As BlackRock partners with Securitize to launch a tokenized private equity fund, the landscape of asset management is experiencing a significant shift towards tokenization, which offers the potential to refine operations and enhance investment strategies.

This shift brings a fresh perspective especially on increasing data management efficiency. Tokenization automates workflows and standardizes data handling, significantly reducing the manual work usually necessary for reconciliation tasks. Such changes could have a profound effect on the industry by cutting operational costs, individualizing investment products and speeding up transaction processes, potentially opening up a $400 billion annual revenue opportunity.

Consequently, an increasing number of financial institutions, Web3-native companies, and fintechs are exploring opportunities within this evolving space, leading to the development and launch of innovative product offerings.

At Particula, we’ve developed the first rating and analytics platform for those innovative investment vehicles. We provide quality assessments and in-depth analysis reports, focusing on technical, economic, environmental, and compliance aspects of all kinds of tokenized assets. Our mission is to offer the next generation of ratings for the next generation of assets, providing investors with instant security, clarity, and improved market access.

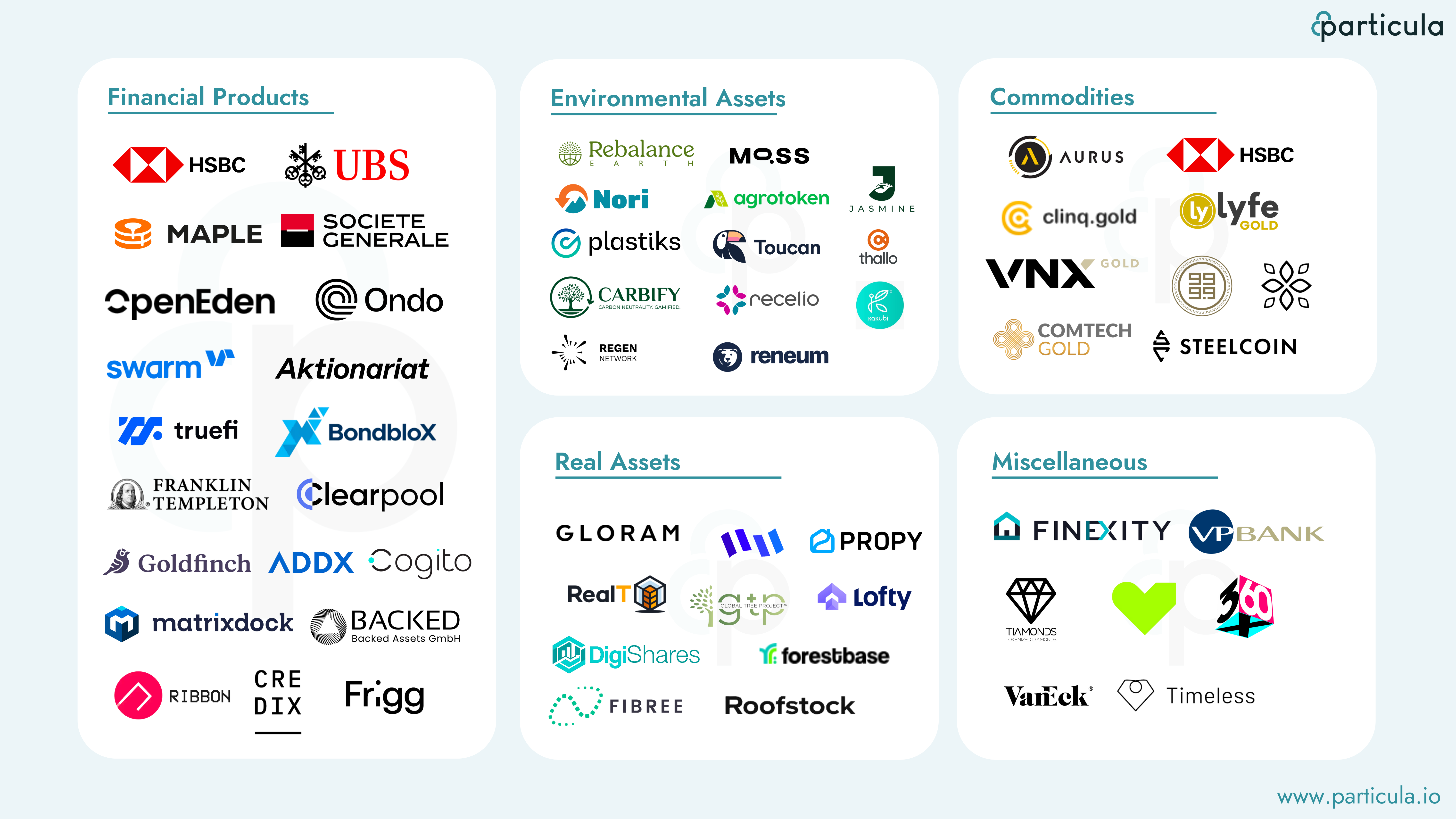

To date, we’ve identified over 1000+ tokens across 20+ asset classes, including Financial Assets (Fixed Income, Equities), Real Assets (Real Estate, Forestland, Infrastructure), Environmental Assets (CO2, Biodiversity, Renewable Energy), Commodities (Precious Metals, Rare Earths), and many more.

As the market evolves we would like to use the opportunity to give you a glimpse into 500+ active stakeholders who are engaged in the issuance of tokenized financial and real-world assets. This overview provides an introduction to the diverse and dynamic field of tokenization and shows the broad participation in various sectors and asset classes.

Additionally, we will soon be opening up certain parts of our platform to allow anyone interested to perform due diligence on the tokenization market.

To gain access to all features of the platform, please contact our co-founder and CGO, Nadine Wilke, at nadine.wilke@particula.io

Financial Assets

Tokenizing financial assets across equity, fixed income, and both private and public markets could greatly improve transaction efficiency, transparency, and accessibility. Moving stocks, bonds, and funds onto blockchain has the potential to reveal hidden value for market participants with Porsche Consulting anticipating processing cost reductions of 35–50%. This shift is expected to lighten regulatory burdens, marking a significant simplification of the E2E value chain for the first time in over a decade. Blockchain’s immediate and automated transactions promise to enhance operational efficiency, reduce settlement times, and minimize counterparty risks.

One of the current standout applications of this technology is the tokenization of money market funds, which introduces numerous benefits including continuous tradability, an efficient cost structure, and bespoke liquidity solutions, all while maintaining complete transparency. This innovation allows for the creation of liquid, interest-bearing investments that offer the flexibility to adapt to market changes, providing a contemporary solution for liquidity management.

HSBC, founded in 1880 in London, UK, employs tokenization and DLT for efficient asset investment, spanning traditional bonds, gold, and virtual assets.

UBS, founded in 1998 in Zurich, Switzerland, provides tokenization services for traditional financial assets, including call warrants, with Xiaomi Corporation serving as the underlying stock.

Franklin Templeton, founded in 1947 in San Mateo, USA, launched the first OnChain U.S. Government Money Fund using blockchain for transactions and ownership records.

Société Générale, founded in 1864 in Paris, France, issued the first structured product as a Security Token and launched a tokenized green bond to improve issuance efficiency and impact tracking.

Ondo Finance, founded in 2021 in New York, USA, specializes in tokenization services focusing on institutional-grade fixed income products, e.g. treasuries and money market funds.

Maple Finance, founded in 2020 in Melbourne, Australia, specializes in blockchain-based lending and borrowing services, focusing on loans backed by U.S. treasury bonds and reverse repurchase agreements.

Goldfinch Finance, founded in 2020, specializes in decentralized finance solutions offering loans fully collateralized with off-chain assets, avoiding crypto collateral necessity.

Backed Finance, founded in 2021 in Zug, Switzerland, focuses on tokenization services, issuing ERC-20 tokens representing real-world assets such as stocks and ETFs.

Swarm, founded in 2020 in Berlin, Germany, tokenizes US Treasury Bills and public stocks, facilitating integration with cryptocurrencies for institutions and retail investors.

ADDX, founded in 2017 in Singapore, focuses on providing digital access to private market investments like private equity and hedge funds.

BondbloX, founded in 2016 in Singapore, specializes in providing fractional bond investments with a lower entry point of $1,000.

Frigg founded in 2022 in Zug, Switzerland, focuses on sustainable finance through a B2B SaaS platform that connects investors directly with sustainable projects.

OpenEden, founded in 2022 in Singapore, tokenized the first real-world asset (RWA) vault, offering 24/7 direct access to U.S. Treasury Bills and enabling the earning of U.S. Treasury yields on-chain.

TrueFi, founded in 2020 in San Francisco, USA, oversees $1.7 billion in loans, manages $40 million in interest, and offers access to a U.S. Treasury Bill Fund on-chain.

Clearpool, founded in 2021 in Singapore, focuses on permissionless lending markets, offering dynamic, risk-adjusted interest rates for both institutional and retail participants globally.

Aktionariat, founded in 2020 in Zurich, Switzerland, specializes in digital tools that allow companies to tokenize their shares and create a direct market for them on their website.

Cogito, founded in 2022 in New York, USA, tokenizes and offers diverse, fully transparent, and institutional-grade investment products, e.g. U.S. Treasury Bills and corporate bonds.

Matrixdock, founded in 2023 in Singapore, offers a digital assets platform that provides institutional and accredited investors with access to tokenized U.S. Treasury Bills.

Ribbon Finance, founded in 2020 in Singapore, provides a suite of DeFi protocols that help users access crypto structured products.

Credix, founded in 2021 in Antwerp, Belgium, connects investors with credit opportunities in emerging markets, focusing on facilitating loan transactions to enhance global liquidity.

Environmental Assets

With respect to environmental assets, the integration of emerging technologies has the potential to optimize transparency, traceability, and liquidity. Utilizing Distributed Ledger Technology (DLT), the Internet of Things (IoT), and Artificial Intelligence (AI), enables real-time monitoring and ensures data integrity. The integration streamlines operations, boosts funding opportunities, and refines the monitoring, reporting, and verification (MRV) process. Additionally, it could elevate market liquidity and the quality of credits (e.g. carbon, biodiversity, renewable energy), directing more revenue toward environmental projects and aiding in the reduction of global emissions.

This increase in data clarity and transparency facilitates effective monitoring of environmental investments, offering a new layer of accountability and preventing reputational risks associated with potential greenwashing.

Toucan, founded in 2021 in Zug, Switzerland is a blockchain-based initiative aimed at integrating carbon markets with blockchain technology by facilitating the tokenization of carbon credits.

The Regen Network founded in 2017 in Great Barrington, UK, brings together validators, wallet holders, and projects, in collaboration with partners such as Moss.Earth, to transform carbon credit markets for ecological regeneration.

Moss, founded in 2020 in São Paulo, Brazil, combines environmental sustainability with blockchain technology to offer tokenized carbon credits for emission offsetting on cryptocurrency exchanges.

Jasmine Energy founded in 2022 in Washington D.C., USA, supports sustainability by enabling the trading of renewable energy certificates in a marketplace that is transparent and accessible, to achieve net-zero emissions.

Thallo, founded in 2021 in Basildon, UK, is a company that focuses on utilizing blockchain technology to change how carbon credits are purchased, sold, and traded by individuals and businesses.

Plastiks, founded in 2019 in London, UK, uses blockchain and NFTs to address plastic waste transparently, enabling businesses to aid recovery efforts in under-resourced areas.

Nori, founded in 2017 in Seattle, USA, is creating financial tools to monetize carbon removal, focusing on soil sequestration by rewarding farmers for regenerative agriculture.

Rebalance.Earth, founded in 2020 in London, UK, employs technology such as Blockchain, AI, and IoT to generate carbon credits, facilitating its mission to nurture a balanced relationship between humanity and Earth.

Carbify, founded in 2022 in Pudisoo, Estonia,combines blockchain and reforestation, connecting NFTrees to Amazon trees for carbon capture tokenization.

Kakubi, founded in 2022 in Zug, Switzerland, is the initial bridge service connecting physically compliant and composable carbon to Ethereum, enabling access to European Union Allowances from the EU ETS.

Reneum, founded in 2018 in Singapore, offers a marketplace that enables funding of renewable energy and other green initiatives through digital credits.

Recelio, founded in 2018 in Kaiseraugst, Switzerland, promotes biodiversity and regeneration through syntropic farming, targeting to support a transition towards a life-sustaining system.

Agrotoken, founded in 2020 in Buenos Aires, Argentina, tokenizes agricultural products, facilitating exchanges for goods, services, and financing in the agribusiness sector through a digital platform.

Commodities

Enhanced visibility and tracking throughout the supply chain stand out as key benefits of commodity tokenization. By incorporating detailed data, particularly about how precious metals like gold and silver are mined, trading desks can now assess adherence to ESG (Environmental, Social, and Governance) standards in production areas.

This insight enables traders to predict potential price surges in these assets and craft effective trading strategies accordingly. Additionally, pioneering projects in the areas of wheat, soy, beans, and even uranium tokenization, open up new possibilities for investment and strategic planning in both traditional and novel commodities.

HSBC, founded in 1880 in London, UK, offers tokenization of physical gold for efficient trading and potential fractional ownership via their Evolve platform, catering to retail investors.

Aurus, founded in 2018 in London, UK, is a blockchain-based platform that facilitates the tokenization of precious metals such as gold, silver, and platinum.

Novem Gold, founded in 2018 in Linz, Austria, uses blockchain for secure gold transactions, with a fee structure offering discounts for using the NVM NOVEM PRO token, which can also increase in value.

Clinq Pay, founded in 2021 in Dubai, UAE, merges blockchain with gold and has initiated a secure, USSD-based payment pilot in Zambia to advance financial inclusivity across Africa.

ComTech Gold, founded in 2022 in Dubai, UAE, is a fintech company focusing on enabling the acquisition and trading of gold through its digital token, the CGO.

VNX, founded in 2022 in Vaduz, Liechtenstein, specializes in tokenizing real-world assets and offers products including VNX Euro (VEUR), VNX Swiss Franc (VCHF), and VNX Gold (VNXAU).

Steelcoin, founded in 2022 in Vienna, Austria, represents the first security compliant with the EU Prospectus Regulation that introduces real steel to the blockchain.

e-Grains, founded in 2023 in San Salvador, El Salvador, introduces digital assets for agro commodities investment, focusing on transparent and sustainable trading and financing.

Lyfe Gold, founded in 2019 in Jakarta, Indonesia, secures its LGOLD tokens with physical gold, offering an alternative option for crypto trading and real asset exchanges through blockchain.

Real Assets (Real Estate, Infrastructure, and Land)

The tokenization of real assets, including real estate, infrastructure, and land has the potential to significantly transform established investment and management practices. Using dynamic Non-fungible Tokens (NFTs), which allow the reflection of real-time changes in an asset’s state or value, offers the possibility for investors to gain a more accurate and current understanding of how these assets evolve.

This approach could democratize access to these markets by lowering traditional entry barriers and potentially increasing liquidity in sectors known for their illiquidity. Moreover, it may allow for more precise asset valuation, facilitate smoother ownership transfers, and enhance the due diligence process. Additionally, it could streamline property transactions, enhance asset valuation accuracy, as well as improve the due diligence process, fostering a more inclusive, efficient, and transparent investment landscape. Through tokenization, the real asset market has the potential to create a more inclusive, fluid, and transparent investment landscape.

Gloram Real Estate, founded in 2018 in Frankfurt, Germany, by Ziper and Kleinerüschkamp, has evolved into a key real estate investor with a €500 million portfolio.

Roofstock, founded in 2015 in Oakland, USA, is reshaping the landscape of real estate investment, aiming to make it accessible and straightforward globally, with over $5 billion in transactions completed.

Lofty, founded in 2018 in Miami, USA, is a platform that democratizes real estate investing across the United States by offering fractional ownership in rental properties.

RealT, founded in 2019 in Miami, USA, simplifies real estate investment by offering fractional, tokenized properties on the Ethereum blockchain.

DigiShares, founded in 2018 in Aalborg, Denmark, provides a real estate crowdfunding platform with automated processes, multiple currency support, high security through audited smart contracts, and electronic facilitation of shareholder functions.

FIBREE, founded in 2018 in Amsterdam, Netherlands, fosters blockchain adoption in real estate, uniting experts to shape the industry’s future, managing expectations, and facilitating collaboration between real estate and blockchain professionals.

Homebase, founded in 2022 in Oakland, USA, is a platform that facilitates real estate investment through tokenization, allowing individuals to invest in real estate with as little as $100.

Propy, founded in 2015 in Miami, USA, implements new technology like Blockchain and AI to streamline real estate transactions.

GlobalTree, founded in 2020 in Zug, Switzerland, tokenizes sustainable forestry profits with the TREE Token, offering investors a stake in the project.

Forestbase, founded in 2021 in Zug, Switzerland, focuses on conserving forests by making them investable, leveraging nature equity to promote sustainability and biodiversity.

Miscellaneous

The “Miscellaneous” category includes a wide range of tokenization initiatives that go beyond traditional assets. These include the tokenization of luxury goods such as classic cars, diamonds, fine wines, and art, as well as intellectual property rights, particularly in the music sector. One remarkable development in this area is the launch of SegMint, an NFT marketplace and digital asset platform.

This project is a joint venture between VanEck, an international investment manager, and innovative technology companies such as Nueva.Tech, Delegate.xyz, MINTangible.io, Portals.to, and Walletchat.fun. By the end of March 2024, SegMint aims to enable users to divide ownership of tokens representing luxury goods such as watches and fine wines into fractions, offering a new way to invest in and own a portion of these high-value goods.

Sygnum Bank, founded in 2017 in Zurich, Switzerland, enables fractional ownership through tokenization, providing legal and financial expertise for investors to access unique assets via platforms like Desygnate and SygnEx.

VanEck, founded in 1955 in New York, USA, is an established asset management firm, that extends into digital assets with its NFT platform, SegMint, for fractional luxury asset ownership.

VP Bank, founded in 1956 in Vaduz, Liechtenstein,

offers financial solutions that include tokenized art, watches, diamonds, and musical instruments.

360x, founded in 2021 in Frankfurt am Main, Germany, operates as a marketplace for tokenized rights in various alternative asset classes, including art, music, and real estate.

Finexity, founded in 2018 in Hamburg, Germany,

enables access to diverse alternative investments such as real estate, art, fine wine, classic cars, and diamonds.

Timeless, founded in 2020 in Berlin, Germany, specializes in fractional investments in rare collectibles like art and watches via blockchain, targeting retail investors.

Tiamonds, founded in 2018 in Vaduz, Liechtenstein, simplifies investment in tokenized diamonds, ensuring they are backed, validated, and insured within Swiss vaults.

heartstocks, founded in 2020 in Hamburg, Germany,

provides White Label solutions for asset managers to enable the tokenization of a variety of assets, including classic cars, watches, companies, and intellectual property.

Sneak-Peak: Asset-Backed Payment Tokens

One of the primary challenges hindering the institutional adoption of tokenization is the absence of digital currencies. While efficiency gains can be achieved on the asset side, institutions still find themselves reverting to traditional processes for handling cash transactions. According to the Digital Euro Association, 108 jurisdictions are currently working on Central Bank Digital Currencies (CBDCs).

Concurrently, we are witnessing the emergence of tokenized deposits and FIAT-pegged stablecoins, such as the AllUnity project – a collaborative effort between Galaxy Digital, DWS, and Flowtraders. While mature initiatives exist in the market, novel approaches are giving rise to asset-backed stablecoins. These stablecoins are pegged to real-world assets such as precious metals like gold and silver or environmental assets like carbon credits.

Onyx by J.P. Morgan, founded in 2020, in New York, USA, offers a blockchain platform focusing on the tokenization of deposits, aiming to facilitate the exchange of value and digital assets worldwide.

Tether, founded in 2014, in Road Town, Virgin Islands, provides a blockchain-based platform for digital versions of traditional currencies, aimed at facilitating global transactions with stable digital currency.

Circle, founded in 2013 in Boston, USA, is a technology company focusing on the use of blockchain for financial transactions, notably with its US dollar stablecoin.

MakerDAO, founded in 2015 in Frederiksberg, Denmark, is a decentralized financial ecosystem that focuses on providing a stable and unbiased digital currency called Dai.

PAXOS, founded in 2012 in New York, USA, offers blockchain solutions for asset tokenization and settlement, including payment tokens backed by fiat or gold, collaborating with firms like PayPal and Bank of America.

Kinesis, founded in 2018 in Grand Cayman, Cayman Islands, is a global trading and investment platform that re-introduces physical gold and silver bullion as currencies that integrate with today’s online banking and payment solutions.

Apraemio, founded in 2022 in Budapest, Hungary, leverages VMF technology for its APRA token, backed by gold, merging blockchain technology with traditional gold investments.

Brale, founded in 2022 in Des Moines, USA, provides a platform for the creation and management of multi-chain digital assets, including fiat-backed stablecoins, to facilitate asset interoperability across different protocols.

VeraOne, founded in 2019 in Newport, UK, offers a platform for ERC-20 tokens backed by precious metals like gold, silver, platinum, and palladium, stored securely in Geneva.

Frax Finance, founded in 2019 in George Town, Virgin Island, was introduced as the first fractional-algorithmic stablecoin system that combines collateralized and algorithmically stabilized elements for its FRAX token.

About Particula

At Particula, we’ve developed the first rating and analytics platform for those innovative investment vehicles. We provide quality assessments and in-depth analysis reports, focusing on technical, economic, environmental, and compliance aspects of all kinds of tokenized assets. Our mission is to offer the next generation of ratings for the next generation of assets, providing investors with instant security, clarity, and improved market access.

To date, we’ve identified over 1000+ tokens across 20+ asset classes, including Financial Assets (Fixed Income, Equities), Real Assets (Real Estate, Forestland, Infrastructure), Environmental Assets (CO2, Biodiversity, Renewable Energy), Commodities (Precious Metals, Rare Earths), and many more.

To learn more or gain access to our platform, please contact our co-founder and CGO, Nadine Wilke, at nadine.wilke@particula.io